Welcome to Fractional, the only weekly newsletter delivering actionable insights on fractional investments. Each week we do a deep dive into an asset you need to know about.

Twitter. Website. Read time = 5 thunderous minutes.

Email us with questions: wyatt@huxmax.com

PLEASE click on that little heart ☝️ if you like what we’re putting out there.

[PS read to the bottom for some bonus analysis of today’s Ty Cobb card.]

What is Journey into Mystery #83

This comic, published in 1962, is the first time the canonical Thor made an appearance in comic book form. Another Thor appeared earlier in Venus 12-13, but most enthusiasts dismiss that version:

The argument for Journey Into Mystery #83 is that that was the 1st appearance that we recognize as the modern day Thor. The Venus appearances were a random god character and/or should be disregarded for pre-dating (by a decade or so) the Thor canon associated with the character we all know.

Read the debate here. It gets heated.

Thor’s cultural relevance

Thor is consistently one of the most popular characters from the Marvel comics universe.

He ranks #2 here, #6 here, #7 here, #12 here, and on and on.

His three feature Marvel films grossed nearly $2B in cinemas.

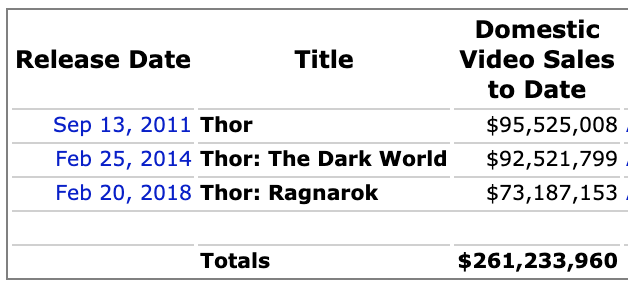

American video sales add another $261m.

He’s also appeared or been mentioned in a further ten MCU films, three TV series', loads of games, web series’, and comics.

5,431 Thor action figures are currently for sale on eBay.

There are 192m google results for Thor with 550k searches per month

For context, here are a few other names you may know

Spider man - 961m (1.2m per month)

Tom Brady - 100m (2.2m)

Lebron - 135m (200k)

Pokemon - 500m (1.5m)

Thor is a big F-ing deal.

Asset valuation

Recent sales

Recent sales of the 9.4 rated Journey into Mystery #83 have been all over the shop. There’s a positive trendline, but that’s really only because we’ve got a very low comp from 2005.

Remove that historic data point, and the trend goes negative.

But…

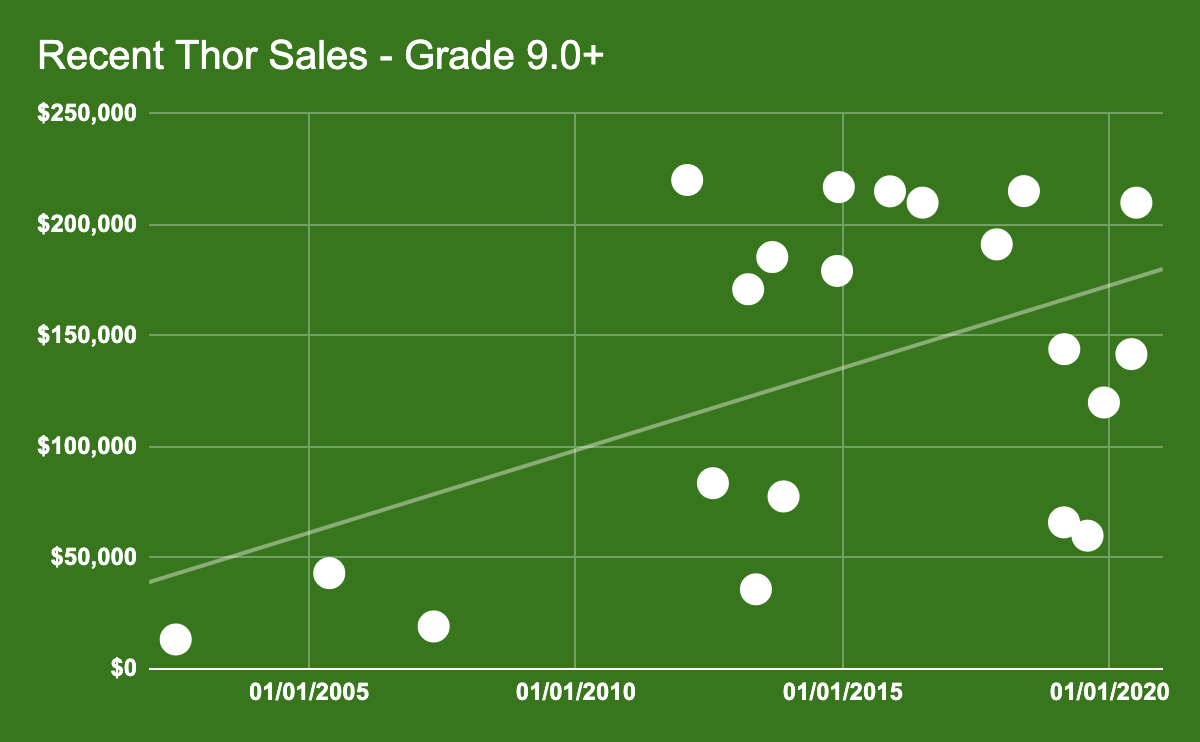

What happens when we look at a wider variety of grades for this issue?

Each rating 9.0 to 9.4 is trending up (there’s only one sale of 9.6).

And if you construct a trendline for the entire data set, the trend is clearer.

Category and sub-category performance on Rally

Thor is the 20th comic to IPO on Rally, so there’s a decent amount of data to look at. Of those, eleven have had a trading window so far.

To date, every comic to IPO with Rally has a positive ROI

Sorry about Superman 21…the recent trading window where it went bananas really skews the aesthetic in my chart.

Median ROI for the comic subcategory is 17.8%, and median annualised return is 35%.

Perhaps the best recent asset to compare Thor to is ‘63 Marvel Tales of Suspense #39 in which Ironman made his debut.

That asset’s recent price history was all over the place as well.

Outlook + future catalysts

Despite the logical end Avengers: Endgame presented, the wildly-profitable MCU shows no signs of slowing down, with a number of films schedule for release.

Buoyed by that and the increased focus on alt assets in general, the outlook for comics is strong.

In fact, a fourth Thor film is planned for release May 6, 2022.

Each previous film spiked interest in Thor, and we can expect the same in mid-2022.

Other Factors to consider

IPO share price has a big impact on annualised return with Rally.

Thor is priced right at $20 per share, which looks like Rally’s new sweet spot.

But don’t expect Thor to go apeshit the way Superman 21 did this week. Both its market cap and share prices are much higher, which will reduce the number of people throwing money at the asset for fun.

In fact, its market cap ($215,000) is on the higher side of non-car IPOs as well.

That’s not necessarily a problem, though, if you’re happy with 50% + annualised returns.

Verdict

I expect Thor to be a solid performer in a balanced portfolio:

Cultural relevance is (and will continue to be) high

There are strong category comps to rely on

The overall trend for the asset is strong

This one is a 4/5 buy for me.

Bonus Cobb Content

Did a thread on this one today. It feels…odd.

Disclaimer 1: I plan to buy shares of this asset.

Disclaimer 2: Nothing in this email is intended to serve as financial or legal advice. Do your own research, you lazy rascals.