Welcome to Fractional, the only weekly newsletter delivering actionable insights on fractional investments.

This week we’re trying out a slightly new format where we look at two assets instead of one.

Twitter. Website. Read time = 8 Pokey minutes.

Email us with questions: wyatt@huxmax.com

PLEASE click on that little heart ☝️ if you like what we’re putting out there.

1998 Game Boy Pokemon Blue - 9.4 WATA Grade | A++ seal

What is the the 1998 Gameboy Pokemon Blue

Released in 1996, the Red, blue and green pokemon games slotted into the then-seven-year-old Gameboy platform. Together, the games sold over 31 million copies—second only to Tetris which sold 35m.

I wouldn’t usually do a write up for an asset that’s going to have such a small share cap (almost defo < $100).

But this one is worth a look, because an almost identical item is trading live already on another platform.

Cultural Relevance of Pokemon Blue

These games are widely credited as the inception point of the Pokemon franchise. This franchise, worth over $92B, is the most valuable media franchise in the world.

In the US alone, there are 1.5m monthly searches for the broad term Pokemon, and over 1.7B search results.

Valuation

Let’s look at both assets together (one IPO’ing on Rally, one trading on Otis).

Both items are WATA rated 9.4 (population 8). There are two differences:

The seal. Rally’s is A++ while the one on Otis is A.

Production date. Rally’s has the white E on the box instead of a black E.

Some facts you need to know about video game grading and sales.

Grading and valuing game cartridges is tire fire wild west stuff. If you think baseball cards are alt, this is alt alt.

There are two primary ratings authorities for video game cartridges: (1) WATA and (2) VGA.

Neither releases population data, and this is VGA’s site:

But more importantly, there’s just no logic to the valuation of these games. Because the trading is so thin, and it’s so new, no one really agrees what anything is worth.

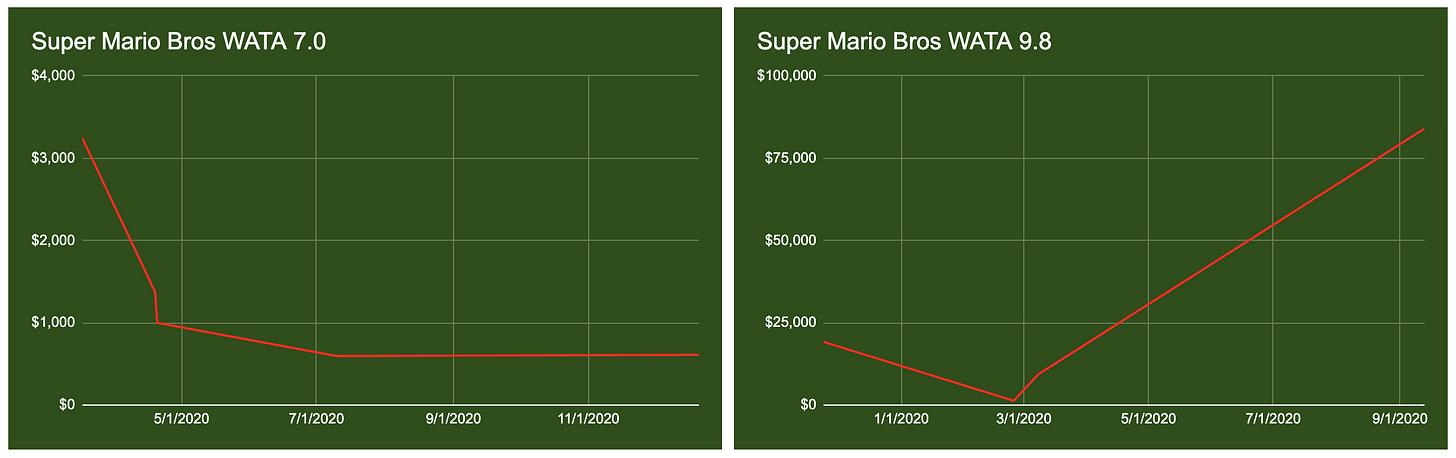

As an example, here’s the price history for a more widely-traded game, the original NES Super Mario Bros. On the left, WATA 7.0 graded cartridges; on the right, 9.8:

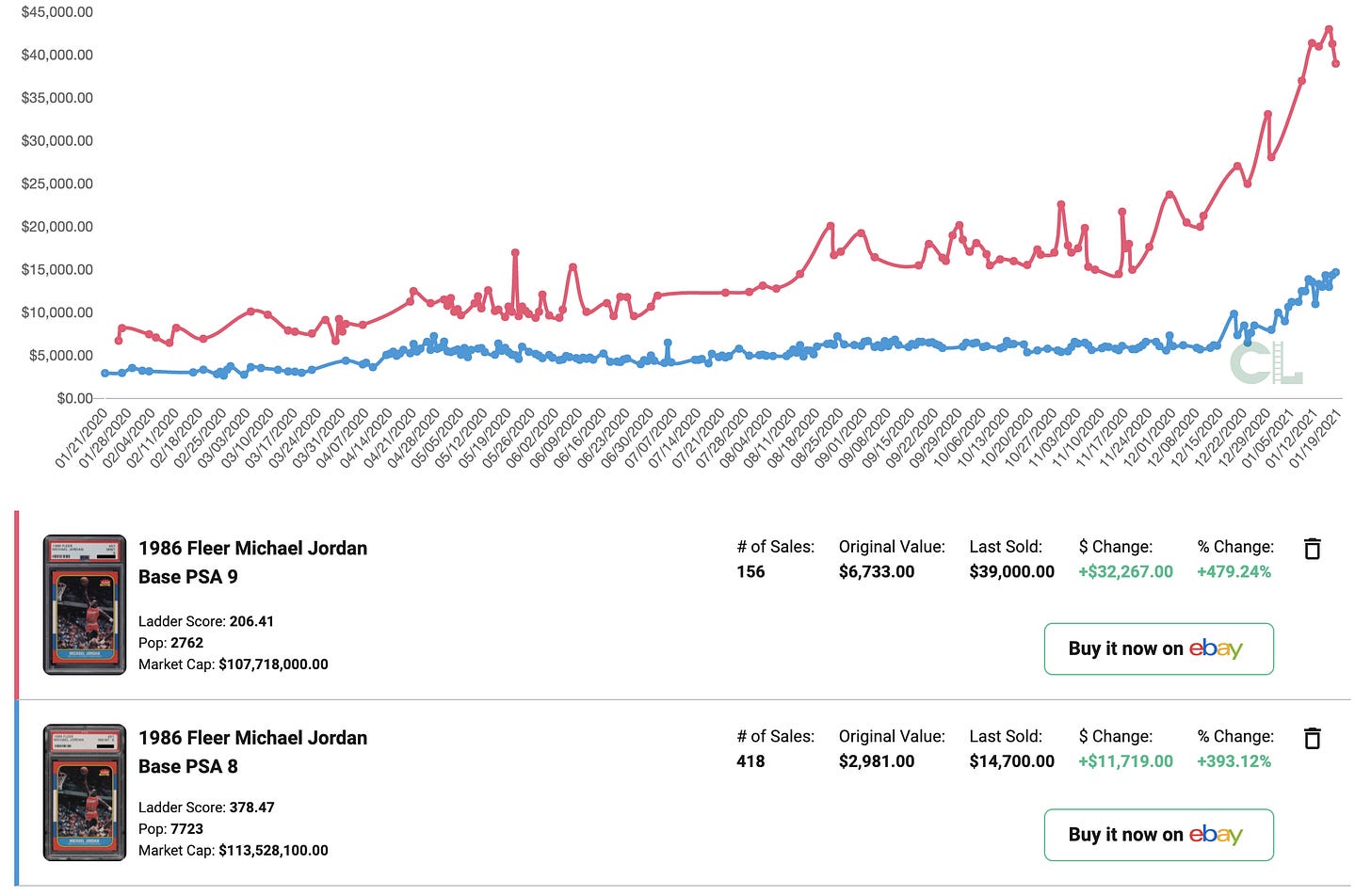

The prices are going opposite directions. Same game, different directions. With more established collectables like baseball cards,the same card’s different grades move in lockstep with each other. eg the 1986 Fleer Michael Jordan

The Pokemon Blue data is worse. Here’s all the WATA graded trading data we have for 2020 - 2021.

This data is incoherent. Certainly no one has any idea what it’s worth to the granularity of a 9.4 graded A seal v an A++.

However, I can say with some confidence the game’s current FMV is probably not $24,000.

Category performance

Three video games have started trading across Rally and Otis, and their combined ROI is 143%.

Outlook and catalysts

Pokemon is hot right now, and there’s another film coming out in the US in 2021.

Game cartridges are very early in the investment cycle and are likely to continue to grow off the back popularity generated by sportscards.

Verdict

Pokemon Blue will fund out with Rally despite the share cap, and it’ll do so quickly, I think.

In theory, the Otis copy should increase in value to match the Rally version over the next few weeks.

So if you’re looking for action here, buy up shares in Otis and wait for the two to converge. Just remember, the market can stay irrational longer than you can stay liquid.

This is a 2/5 for me (avoid).

1984 Michael Jordan Signing Day Jersey

What is the MJ signing day jersey?

This is the jersey presented to Michael Jordan when he signed for the Bulls in 1984. It’s unworn and doesn’t have an autograph.

What’s Michael Jordan’s cultural relevance

I won’t insult your intelligence by going into this deeply, but there are 20 Michael Jordan assets trading or listed to trade among the three biggest collectable fractional marketplaces. That’s about 6% all for one guy. More than all other NBA players combined.

After this IPO, there are still four more MJ items set to IPO in the future (that I know about).

Asset Valuation

This is a pseudo one of a kind item. There are plenty of comps out there for game-worn Jordan jerseys, and Rally does a good job of charting those for us.

At $375k, this jersey is off the scale and leaves Rally with a healthy $55k sourcing fee, but that purchase was six weeks ago. Six weeks ago, a 1986 Fleer Michael Jordan PSA 10 could be had for $150k, and the most recent sale was $250k — 66% appreciation in that time.

If you use that quite reasonable metric, the value of this jersey is a 66% advance on $320k, or $531k.

Category and subcategory performance on Rally

Items in the sports memorabilia category on Rally are averaging 83%, while the only two basketball memorabilia items are doing even better.

Outlook and future catalysts

Michael Jordan will stay hot as long as Michael Jordan stays hot. The MJ trend has carried on longer than many anticipated, and it’s not slowing down yet.

A 1986 - 1987 Fleer NBA box sold for a new record price on 18th January for $225,100.

I don’t know when MJ is going to cool off, but it’s definitely a significant risk factor.

That said, Gary V came out yesterday with a $1M price target for the 1986 Fleer card, so 🤷🏽♂️.

Other factors to consider

This item will 100% fund, and it’s going to fund very quickly (within 10 minutes).

And I think it may even be worth $531k as I said above.

That said, here are a couple things to think about:

How much Jordan exposure do you have already? If you’re already into him with a few other items, you may want to let this one go.

There’s a 90 day lock up period on all Rally IPOs. If MJ cools down before April, you may be stuck.

This is a 3/5 for me. If you don’t already have exposure to MJ in your portfolio, this is a good pick up.

Update - an earlier version listed the Pokemon game with Otis as A+ rather than A. I’ve also added information about the production date (Rally’s is older).

Disclaimer 1: If funds hit my Otis account while it’s still at $15, I plan to pick up a few shares there to test out my arb theory.

Disclaimer 2: Nothing in this email is intended to serve as financial or legal advice. Do your own research, you lazy rascals.

Sponsorship

Interested in sponsoring Fractional? Let’s chat.

Each issue of Fractional receives over 600 impressions.

Pointed out by a subscriber...the game from Rally is older than the one trading on Otis, though it's impossible to tell how much older.

The giveaway is the colour of the E on the box.

https://www.reddit.com/r/gamecollecting/comments/4o592l/are_there_different_esrb_e_color_for_the_same_gbc/

I'd originally intended to include an analysis of the Dickens trading today here as well, but I ran out of time.

Here's a thread about it

https://twitter.com/itiswyatt/status/1352223001383727104?s=20