Q&A with Collectable CEO Ezra Levine

All about the Collectable trading platform, transparency, and int'l expansion.

Welcome to Fractional, the only weekly newsletter delivering actionable insights on fractional investments.

This is a special one-off issue as the Collectable platform begins trading today.

That’s two one-off issues in one week. Sorry / you’re welcome, depending on how much you liked / hated them.

Collectable’s trading operation goes live today. Their CEO, Ezra Levine, was kind enough to answer a few questions about how that’s going to work + try to clear up some recent questions about their platform’s transparency.

Questions below are from me, answers are from Ezra with Dan Silvershein, Head of Acquisitions & Strategy at Collectable, chiming in as well.

Fractional: Can you please explain how the Power Hour is going to work with the rest of the trading day? Will people put in bids / asks through the day then everything gets settled from 3pm to 4pm? Why not make the whole day a power hour?

Ezra: We’re excited to introduce a continuous, intraday trading feature to the fractional community. Our plan is to “start small” then gradually expand this continuous trading feature across the full trading day. Crawl, then run. Here’s how it will work: bids and asks that have been submitted between trading windows will be matched and executed right at 3pm EST, should they be within market parameters. Then, the market will go continuous for the last hour of the trading day. We’re calling this “Power Hour.”

Investors will only be able to submit bids and asks within +/- 10% from the last trading price. Anything outside of that range will not be displayed during “Power Hour.” Once Power Hour closes, the market goes back into “Post Only” mode until the next eligible trading day.

Fractional: Which assets will be first up on the secondary market?

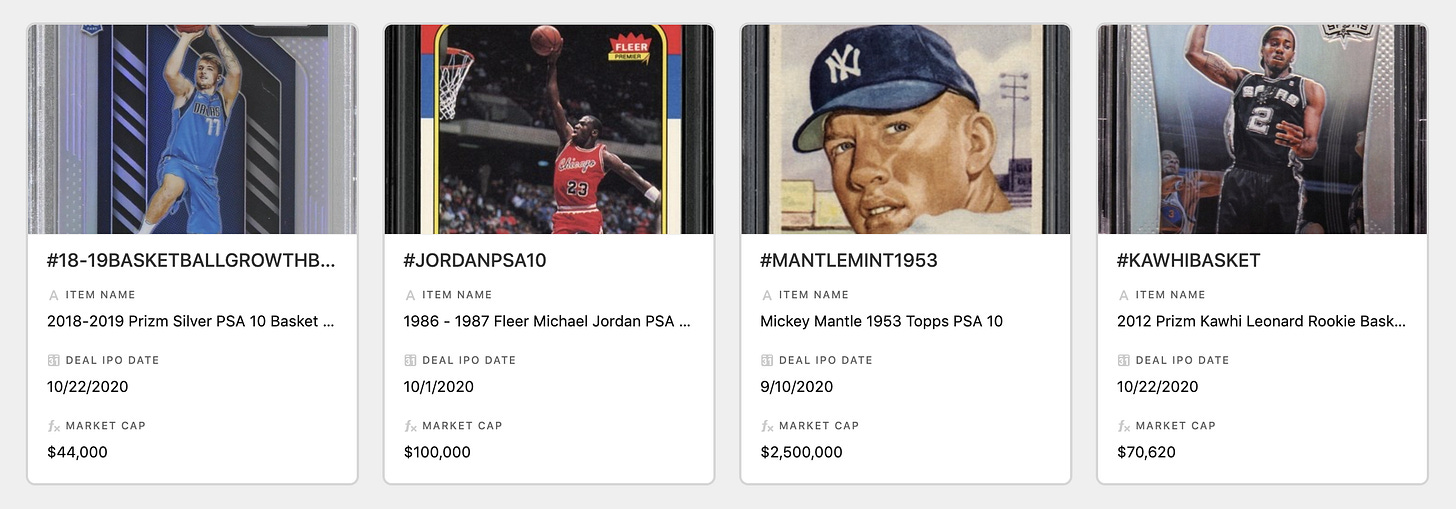

Ezra: Only assets that have cleared the 90-day lock up period will be eligible. These include: Mickey Mantle 1953 PSA 10, Michael Jordan ‘86 Fleer PSA 10, Magic/Bird/Dr. J 1980 Scoring Leader PSA 10 (pending outcome of buyout offer), Babe Ruth & Lou Gehrig dual signed baseball, LeBron James SP Authentic, and the Kawhi Leonard basket.

Fractional: What security will be in place to prevent market manipulation on the secondary market?

Ezra: This is something we’ll monitor quite closely, and we have strong oversight and visibility into the secondary market along with our top notch vendors. We’ve put some preliminary parameters in place. For instance, investors will only be able to submit bids and asks within +/- 10% from the last trading price during ‘Power Hour’. Orders in which an individual investor is both buying and selling simultaneously will be rejected. Suspicious bid/asks will be flagged and reviewed, and potentially canceled.

Our mission is to create a liquid, stable marketplace that mimics the public markets, as closely as reasonably possible. We’ll be thoughtful and active in enforcing any additional parameters, should the need arise.

Fractional: If the unthinkable were to happen to Collectable, and it went out of business tomorrow, what would happen to the shareholders’ assets? What would happen to their shares? Is there any scenario where they would lose any money or stake in the items?

Ezra: Shareholders asset ownership is separate and protected from Collectable Technologies, Inc., our parent company. In the highly unlikely scenario Collectable Technologies, Inc. goes out of business, shareholder assets would be protected. Cash reserves are built into each offering for insurance, storage, and cash on each series balance sheets. As a result, we would be opportunistic and patient in deriving best outcomes for shareholders in each offering. These options could be, but are not limited to, finding an acquirer for these assets, appointing a new Asset Manager to manage the assets, moving the assets onto a different exchange for them to be freely traded, or putting the items up for auction with proceeds paid out pro-rata to shareholders ownership stakes.

Fractional: How do you determine what items to buy and how do you identify owners who are willing to sell on consignment?

Ezra: This is where our category focus is a tremendous advantage. We have the knowledge, the know-how, the relationships and the data to source iconic items for our community. As of writing this, we’ve already either completed or filed over 70+ offerings with the SEC. We’re moving at a rapid pace, without sacrificing quality.

Dan: We also offer our consignors the option to retain a piece of equity in their item if they so choose. This gives us the ability to offer our investors access to some amazing items that may not otherwise come to market.

Fractional: For the harder-to-value items (e.g. jockstraps), do you approach determining a market cap?

Ezra: We utilize best-in-class appraisers, collectors, and auctioneers to help determine the valuation of each asset. In determining a valuation, we look at public and private comparables (if any exist), scarcity and rarity of an asset, growth rates across different types of assets and/or underlying athlete, and many other quantitative and qualitative metrics. Like any valuation exercise, it is more art than science, but we do our best to derive a fair price for shareholders with room for upside based on today’s market conditions.

Dan: We are lucky to have assembled a group of some of the most passionate and respected collectors in the hobby on our team and cap table, as a result we feel that our ability to bring assets to our investors at the best possible price point is second to none.

Fractional: What’s your rollout timeline for international expansion?

Ezra: We’d love to be international ASAP, of course. Unfortunately, when dealing in securities, many countries have their own rules and regulations. We’re working closely with our attorney and our vendors (broker dealers, custodians, etc) to expand as quickly as feasible. I can promise you this: once we CAN, we WILL.

Fractional: Will you always limit pre-sales to a certain percentage of the asset’s value? Or is there a time where you might offer assets to whales and let them buy up the entire asset?

Ezra: “Always” is a difficult word, especially when Collectable is in the “top of the first inning” of our company’s journey. Candidly, this is one the most difficult juggling acts in the fractional space - providing large enough allocations for big clients without losing our mission to democratize the industry. The way we’ve done it so far seems to have struck an appropriate balance, so we’ll stick with it until such as point as we have a reason to adjust.

Fractional: Is there a plan to introduce physical items to go along with share purchases?

Ezra: We’ve begun to introduce them already. For our 1952 Topps Mickey Mantle PSA 8 offering, we introduced a canvas painting by a really talented artist, Kristina Skordas. The reaction was tremendous. I would expect us to do more of those. We understand there’s an interest in providing a tangible representation of intangible investments in the collectibles category, so there will be more to come.

Fractional: When will users be able to buy / sell assets via the desktop site?

Ezra: We’re working on a desktop build out as we speak, and it will certainly be released at some point in 2021. Hopefully sooner rather than later. Providing as many access points as we can to collectors and investors is a top priority.

Fractional: Will you come out with a referral programme?

Ezra: Yes, it’s in the works. Will have more updates as soon as feasible.

Fractional: Are there plans to offer fractional ownership of sports teams or Income Share Agreements (ISAs) with players themselves?

Ezra: Our focus is sports. As the leader in our category, you can expect us to push the boundaries of what’s possible in this vertical. Certainly wouldn’t rule anything out.

Fractional: What's the timeframe, if any, for derivatives and shorting?

Ezra: I love the idea, and fully expect it to happen at some point. As a markets guy, it’s important for participants to be able to express different views. We’re a bit in uncharted territories here, so we’ll need the infrastructure around the space to mature a bit. No timetable, but it’s certainly squarely on our radar. Again, once we CAN, we WILL.

Fractional: Trust and transparency is 100% important as this industry gets off the ground, and Collectable prides itself on that metric. Given that, why do you source items from Collectable shareholders and other affiliated persons? Why even get anywhere near a hint of shadiness?

Ezra: Collectable is fortunate to have some of the largest and most respected collectors in the world on our cap table. This is a huge strategic advantage for us, as it builds a “moat” around supply. It’s our expectation, and I believe the market has already seen it, that Collectable will have some of the greatest sports collectibles in history available to investors of all income at affordable share prices.

The cost basis, and potential profit, of all affiliated supply sources is fully disclosed in our SEC filings, and held to the highest degree of transparency possible.

In fact, if you performed a correlation analysis, you would most likely discover that assets consigned from affiliates have had some of the most advantageous valuations for shareholders.

That said, no one is forced to invest in anything on our platform. We highly encourage all investors to do their own research and due diligence before investing in any of our offerings - whether from affiliated sellers or not.

Fractional: Why do you have an advisory board that removes buy / sell / hold authority from shareholders? Why give any hint that Collectable maintains undue influence over the asset?

Ezra: You’re correct that, legally as it states in our Offering Circular filed with the SEC, Collectable Sports Assets LLC has the final decision as it relates to acquisition offers. This is the case with many fractional ownership platforms. That said, shareholder sentiment is THE key determinant in the outcome of these offers. Collectable’s advisory board is in place to protect shareholders, not to stand in the way of shareholders wishes. It is highly unlikely the advisory board would act in a manner inconsistent with shareholder intentions, unless one or a few large shareholders were acting in a concerning manner.

Fractional: Any final thoughts?

Ezra: Quick note to thank our community for their support over the past four months. Our rock star team is working tirelessly to build the best possible product with the best possible supply for our users, and we’re not going to stop.

We love the hobby, and are excited to bring liquidity, transparency, democracy, and continued innovation to the category as it becomes solidified as a viable alternative asset.

We look forward to rolling out additional features and offerings for our users!

Thanks to you, Wyatt, for providing great content, education and research to the fractional space. Keep going!!

UPDATE: Obviously the buyout went through so the Bird etc card won't be trading today.